In line with the healthcare financing schemes by the Ministry of Health, the following factors may offset the out-of-pocket portion that you will have to pay for your treatment:

- Government Subsidies: The amount of Government subsidies you enjoy

- Insurance: The amount offset by your MediShield Life or Integrated Shield Plan

- MediSave: The amount that you choose to pay through your MediSave account, or through MediSave contributions from your spouse, child or parent

After deducting the amounts associated with the above factors, the remaining amount will be your out-of-pocket payment.

3Ms

MediSave

MediSave is a national medical savings scheme which allows individuals to deposit part of their income into their MediSave Accounts to meet their future personal or immediate family's (spouse, children, parents or grandparents) hospitalisation, day surgery and certain outpatient expenses.

During admission, do inform the Admissions staff if you intend to cover part of your bill with MediSave. You will need to bring your NRIC/Passport or your CPF membership card with you.

If you would like to utilise your/ your next of kin’s MediSave, MediShield Life or Integrated Shield Plans, you are required to sign a Medical Claims Authorisation Form (MCAF). MCAF consent allows you to perform the following at approved institutions:

- Check MediSave balance and available withdrawal limits

- Withdraw from your MediSave to pay for approved treatments

- Claim from your MediShield Life or Integrated Shield Plans to pay for approved treatments

The Ministry of Health has introduced two MCAF forms in Nov 2015:

-

MCAF-M (Multiple) which allows you to grant full, nationwide consent for life, unless revoked, to use your MediSave at all MediSave accredited healthcare institutions. This form provides convenience as you simply need to

sign once, for life.

-

MCAF-S (Single) which allows you to exercise

flexibility should you decide to

provide limited consent to the utilisation of your MediSave Funds. You can choose to limit the type of schemes you would like to use and the time period for which you would like to authorise your MediSave.

MediShield Life

MediShield is a low cost catastrophic illness insurance scheme. First introduced in 1990, the government designed MediShield to help members meet medical expenses from major illnesses, which could not be sufficiently covered by their MediSave balance. MediShield was enhanced in Nov 2015 and renamed as

MediShield Life, thus providing better protection and higher payouts to help patients pay for large hospital bills and selected costly outpatient treatments.

MediShield Life is sized for subsidised treatment in public hospitals. Those who choose to stay in a Class A/B1 wards or in a private hospital are also covered by MediShield Life. However, as MediShield Life payouts are pegged at Class B2/C wards, the MediShield Life payout will make up a smaller proportion of the bill. The patient may therefore need to pay more of their bill from MediSave and/or cash.

Some important points to note for MediShield Life are as follows:

- Mainly designed for B2 or C class hospital bills

- Covers all Singaporeans and Permanent Residents, even those with existing illnesses

- Premium payable by MediSave

Singaporeans may purchase Integrated Shield plans from a private insurer. The Integrated Shield plan will comprise of the following 2 components:

- MediShield Life component run by the Central Provident Board (CPF) Board.

- Additional private insurance coverage component run by the insurance company, typically to cover A/B1-type wards in public hospitals or private hospitals.

MediShield Life is included in all Integrated Shield plans. MediShield Life coverage is for life, including any pre-existing conditions. This is the case even if the pre-existing conditions are not covered under the additional portion of the Integrated Shield plan from a private insurer.

Individuals with an Integrated Shield plan will also receive subsidies for the MediShield Life component, if eligible.

If you have an Integrated Shield plan, you are already covered by MediShield Life. The company you have taken the plan out with acts as your single point of contact. They will act on the CPF Board’s behalf for premium collection and claims disbursement for the MediShield Life component of your Integrated Shield plan.

Similar to MediSave, to activate utilisation of MediShield and

Integrated Shield Plans, you are required to sign a Medical Claims Authorization Form (MCAF).

MediFund

MediFund is an endowment fund set up by the Government to help needy Singaporeans. It is a safety net for patients who face financial difficulties with their remaining bills after receiving government subsidies and drawing on other means of payments including MediShield Life, private Integrated Shield Plans, MediSave and cash.

All subsidised patients applying for MediFund will be required to undergo a financial assessment by one of our Medical Social Workers. Please approach any NCID Staff if you would like to apply for MediFund or any financial assistance.

Inpatient Means Testing

A means-test is used to determine the subsidies for which each individual is eligible for their inpatient admission. It is a way to share limited class B2 and C subsidies in a fair manner, by targeting subsidies at lower income groups. While all patients can still choose their own ward class, the idea is for higher- income patients to co-pay more than lower-income patients, if they choose to stay in subsidised class B2 or C wards. Inpatient means testing is based on your personal income or the annual value of your place of residence. You will receive the same quality medical care regardless of the ward class selected.

Subsidy range for B2 and C class:

Class B2

| 50% - 65% |

Class C | 65% - 80% |

Some important points to note for inpatient means testing are as follows:

- Only applicable for Singaporeans or Permanent Residents (PR)

- Only applicable for Ward Classes B2 or C

- Valid for one year upon consent

- Means Testing is based on:

- Average Annual Income - for Economically Active patients

- Properties’ Annual Value (PAV) - for Economically Inactive patients

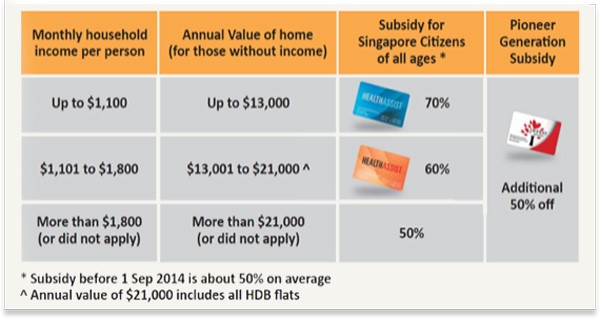

Community Health Assist Scheme (CHAS)

The

Community Health Assist Scheme (CHAS) was introduced by the Ministry of Health in 2012. The scheme enables Singapore Citizens from lower- to-middle income households, as well as all Pioneers, to receive subsidies for medical and dental care at participating general practitioner (GP) and dental clinics.

In order for Singaporeans to qualify for CHAS, they have to meet the following criteria:

- For households with income, the household monthly income per person must be $1,800 and below

- For households with no income, the Annual Value (AV) of the residence reflected on the patient’s NRIC must be $21,000 and below

Singapore Citizens who qualify for CHAS will receive an individual blue or orange Health Assist card. Health Assist cardholders will also enjoy subsidised referrals to Specialist Outpatient Clinics (SOCs) located at Public Hospitals or the National Dental Centre (for dental referrals) when required.

Subsidies at Specialised Outpatient Clinics (SOCs)

Pioneer Generation Package

The Government introduced the Pioneer Generation Package to honour and thank our Pioneers for their hard work and dedication to Singapore. About 450,000 Singaporeans will benefit from the Pioneer Generation Package.

Who is eligible?

Living Singapore Citizens must fulfil the following criteria in order to qualify for the Pioneer Generation Package:

- Be aged 16 and above in 1965 – this means:

- They must be born on or before 31 December 1949

- They must be aged 65 and above in 2014

- Have obtained citizenship on or before 31 December 1986

Click

here if you would like to check your eligibility for the Pioneer Generation Package.

Some benefits of the Pioneer Generation Package are as follows:

- Special Subsidies for Outpatient Care (CHAS clinics, Polyclinics and SOCs)

- Annual MediSave top-ups, for life

- Pioneer Generation Subsidies for MediShield Life Premiums

- Pioneer Generation Disability Assistance Scheme

Click here for more information about the Pioneer Generation Package.